All public and private banks are reliable to take a home loan. Probably, the customer service might vary from bank to bank. If you plan to apply for a home loan with LIC Housing Finance, it is important you know the features, benefits and eligibility criteria of the loan.

LIC Housing Finance is a Non-Banking Financial Company (NBFC) that provides home loans for purchase, construction and extension. The loan amount varies depending on the value of the property.

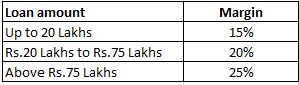

The minimum margin is slightly higher than other banks where you need to pay only 10% of the loan amount for loans up to 30 Lakhs.

The maximum repayment period is 30 years, which however is applicable only for salaried individuals. Meanwhile, self-employed individuals must repay the home loan within 20 years. The lender also provides home loans to NRI customers and pensioners. The repayment period for NRI’s is up to 20 years, and pensioners can decide the repayment term based on their age limit.

The interest rate differs for each individual based on their credit profile. The interest rate on home loan starts from 8.70% onwards.

If you want to take a home loan, you must first check your credit score and check out the offers provided by lenders for your credit profile. Compare the rates with LIC Housing Finance home loan and choose the best one. You must also compare the processing fees, pre-closure charges etc.